Demystifying the Power of Price Markup: A Comprehensive Guide to Profitability

Related Articles: Demystifying the Power of Price Markup: A Comprehensive Guide to Profitability

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Demystifying the Power of Price Markup: A Comprehensive Guide to Profitability. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Demystifying the Power of Price Markup: A Comprehensive Guide to Profitability

In the intricate world of business, profitability is the lifeblood that fuels growth and sustainability. A key element in achieving this profitability lies in setting the right price for products or services. This is where the concept of price markup comes into play, and a price markup percentage calculator becomes an invaluable tool.

Understanding the Essence of Price Markup

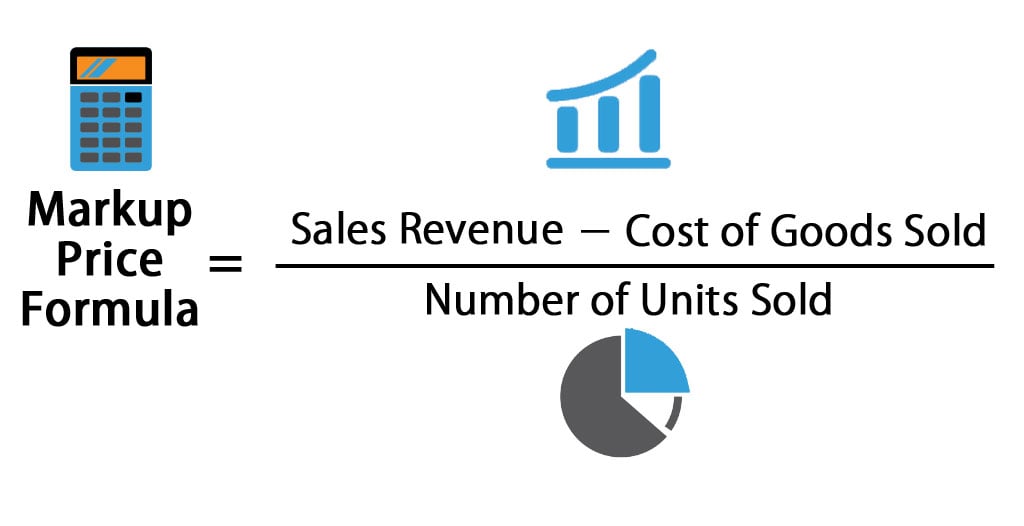

Price markup is the difference between the cost of a product or service and its selling price. It represents the profit margin that a business aims to achieve on each sale. Expressed as a percentage, it helps businesses determine how much they need to add to their cost to cover expenses and generate a desired profit.

The Importance of a Price Markup Percentage Calculator

A price markup percentage calculator serves as a straightforward and efficient tool for businesses of all sizes. It simplifies the process of determining the optimal selling price by automatically calculating the markup percentage based on the cost of goods sold and the desired profit margin. This calculator eliminates the need for manual calculations, reducing the risk of errors and saving valuable time.

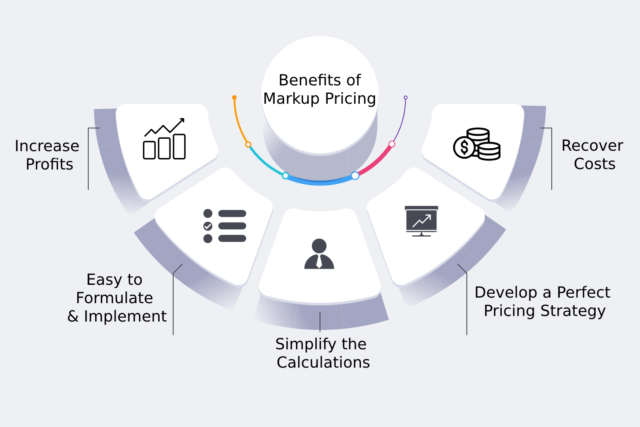

Key Benefits of Utilizing a Price Markup Percentage Calculator

- Accurate Price Determination: The calculator provides precise calculations, ensuring that the selling price reflects the desired profit margin and covers all associated costs.

- Enhanced Profitability: By accurately calculating the markup, businesses can optimize their pricing strategy, maximizing profits and achieving financial goals.

- Streamlined Operations: The calculator streamlines the pricing process, eliminating the need for manual calculations and freeing up time for other critical business tasks.

- Informed Decision-Making: The calculator provides valuable insights into the relationship between cost, markup, and selling price, enabling businesses to make informed decisions regarding pricing strategies.

- Competitive Advantage: By understanding their cost structure and applying the appropriate markup, businesses can position themselves competitively in the market.

Types of Price Markup Calculations

There are two primary methods for calculating price markup:

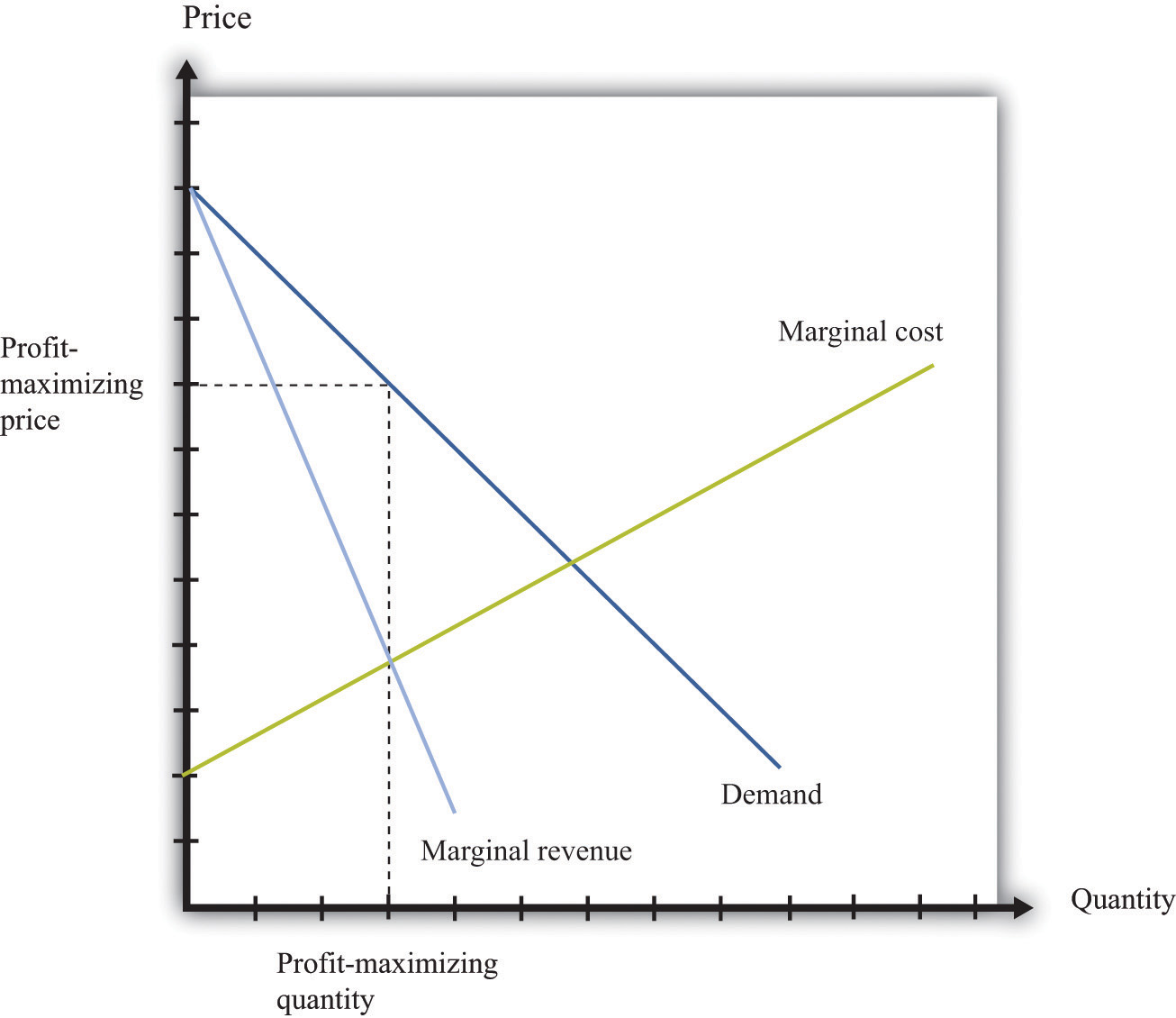

- Cost-Plus Pricing: This method involves adding a predetermined markup percentage to the cost of goods sold. The markup percentage is typically based on the desired profit margin and covers operating expenses.

- Value-Based Pricing: This method focuses on the perceived value of the product or service in the eyes of the customer. It involves setting a price that aligns with the customer’s willingness to pay, rather than solely relying on cost.

Factors to Consider When Determining Price Markup

- Cost of Goods Sold: This includes all direct costs associated with producing or acquiring the product or service.

- Operating Expenses: These are the indirect costs associated with running the business, such as rent, utilities, and salaries.

- Desired Profit Margin: This is the percentage of profit a business aims to achieve on each sale.

- Competition: Businesses need to consider the pricing strategies of their competitors to remain competitive in the market.

- Customer Perception: The perceived value of the product or service influences the price that customers are willing to pay.

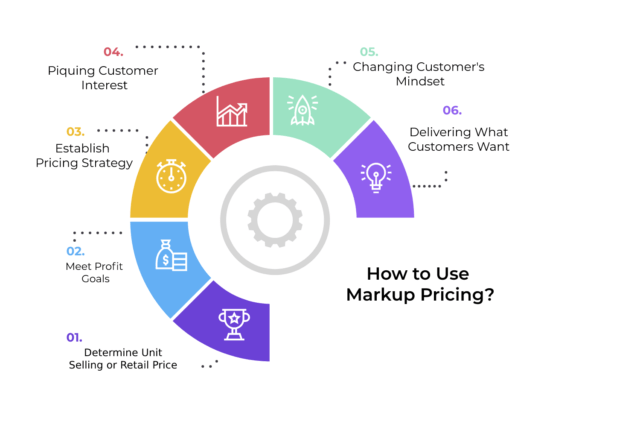

How to Use a Price Markup Percentage Calculator

Most price markup percentage calculators are user-friendly and require minimal input. Typically, you would enter the following information:

- Cost of Goods Sold: This is the direct cost of producing or acquiring the product or service.

- Desired Profit Margin: This is the percentage of profit you wish to achieve.

The calculator will then automatically calculate the markup percentage and the corresponding selling price.

Example: Calculating Price Markup

Let’s say a business sells a product that costs $50 to produce. They desire a profit margin of 20%. Using a price markup percentage calculator, they would input these values:

- Cost of Goods Sold: $50

- Desired Profit Margin: 20%

The calculator would then determine the following:

- Markup Percentage: 25%

- Selling Price: $62.50

In this example, the business would need to add a 25% markup to the cost of goods sold to achieve their desired 20% profit margin. The selling price would be $62.50.

Frequently Asked Questions (FAQs) About Price Markup Percentage Calculators

Q: What is the difference between markup and margin?

A: Markup is the percentage added to the cost of goods sold to determine the selling price. Margin, on the other hand, is the percentage of profit generated on each sale, calculated as (selling price – cost of goods sold) / selling price.

Q: How can I determine the optimal markup percentage?

A: The optimal markup percentage depends on various factors, including cost of goods sold, operating expenses, desired profit margin, competition, and customer perception. It’s important to consider these factors carefully when setting your markup.

Q: Can I use a price markup percentage calculator for all types of businesses?

A: Yes, price markup percentage calculators can be used by businesses of all sizes and industries. They are particularly beneficial for businesses that sell physical products but can also be applied to service-based businesses.

Q: What are some tips for using a price markup percentage calculator effectively?

A:

- Consider all costs: Ensure that you have accurately accounted for all costs, both direct and indirect, when determining your markup.

- Research your competitors: Understand the pricing strategies of your competitors to ensure you are competitive in the market.

- Monitor your results: Regularly review your pricing strategies and make adjustments as needed to optimize profitability.

- Experiment with different markups: Try different markup percentages to see how they affect your sales and profits.

- Use the calculator as a starting point: The calculator provides a useful starting point for determining your selling price, but it’s essential to consider other factors and make adjustments as needed.

Conclusion

A price markup percentage calculator is an indispensable tool for businesses seeking to optimize their pricing strategies and achieve profitability. By accurately calculating the markup percentage, businesses can ensure that their selling prices reflect their costs, desired profit margins, and market conditions. Utilizing this tool empowers businesses to make informed decisions, enhance profitability, and gain a competitive edge in the market.

Closure

Thus, we hope this article has provided valuable insights into Demystifying the Power of Price Markup: A Comprehensive Guide to Profitability. We appreciate your attention to our article. See you in our next article!