Demystifying the Price Markup Calculator: A Comprehensive Guide for Businesses

Related Articles: Demystifying the Price Markup Calculator: A Comprehensive Guide for Businesses

Introduction

With great pleasure, we will explore the intriguing topic related to Demystifying the Price Markup Calculator: A Comprehensive Guide for Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Demystifying the Price Markup Calculator: A Comprehensive Guide for Businesses

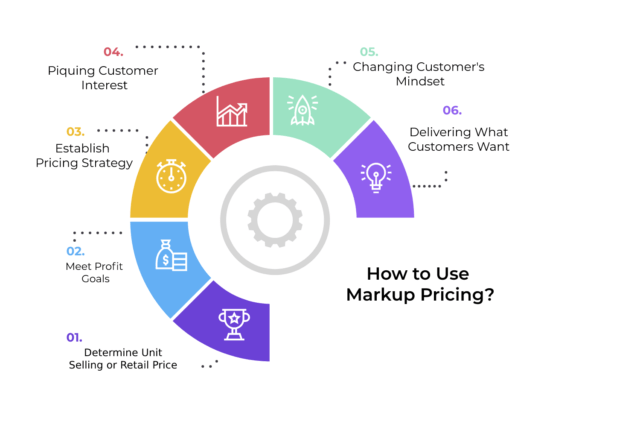

In the dynamic landscape of business, accurate pricing strategies are paramount to profitability and sustainable growth. While cost-plus pricing offers a straightforward approach, it often fails to account for the complexities of market demand, competitor pricing, and the value proposition of a product or service. This is where the concept of markup comes into play.

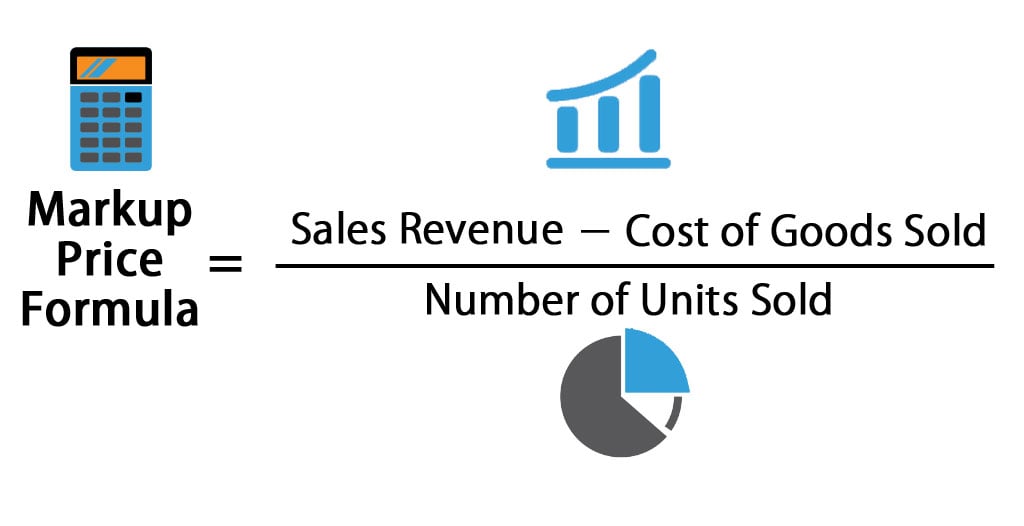

A markup is a percentage added to the cost of a good or service to determine its selling price. It encompasses various factors beyond just covering production costs, such as operational expenses, profit margins, and market competitiveness. Calculating this markup manually can be cumbersome and prone to errors, especially when dealing with multiple products and varying cost structures. This is where a price markup calculator emerges as a valuable tool, simplifying the process and ensuring accuracy.

Understanding the Essence of a Price Markup Calculator

A price markup calculator is a digital tool designed to automate the calculation of selling prices based on cost and desired markup percentage. It streamlines the pricing process, eliminating the need for manual calculations and reducing the risk of errors. This calculator typically requires two key inputs:

- Cost of Goods Sold (COGS): This represents the direct cost associated with producing or acquiring a product or service. It includes raw materials, labor, and manufacturing expenses.

- Markup Percentage: This is the percentage added to the COGS to determine the selling price. It accounts for operational expenses, desired profit margin, and market competitiveness.

The calculator then processes these inputs and generates the selling price, providing a clear and concise representation of the financial implications of the chosen markup.

Unveiling the Benefits of Employing a Price Markup Calculator

Beyond its ease of use, a price markup calculator offers numerous benefits for businesses of all sizes, contributing to better pricing strategies and overall financial health:

- Enhanced Accuracy: The calculator eliminates the possibility of human error in manual calculations, ensuring precise selling prices. This reduces the risk of underpricing, which can lead to lost profits, and overpricing, which can deter customers.

- Increased Efficiency: By automating the pricing process, the calculator saves valuable time and resources that would otherwise be spent on manual calculations. This allows businesses to focus on other critical aspects of their operations.

- Improved Profitability: By accurately determining selling prices, the calculator enables businesses to achieve their desired profit margins. This leads to increased profitability and financial stability.

- Strategic Pricing Decisions: The calculator empowers businesses to experiment with different markup percentages and analyze their impact on selling prices. This allows for data-driven pricing decisions that align with market dynamics and business goals.

- Simplified Cost Management: The calculator provides a clear overview of the cost structure and its relationship to selling prices. This facilitates better cost management by identifying areas where costs can be reduced or optimized.

- Enhanced Transparency: The calculator provides a transparent view of the pricing process, allowing businesses to easily explain their pricing strategies to customers and stakeholders. This builds trust and fosters a positive customer experience.

Navigating the Different Types of Price Markup Calculators

The market offers a diverse range of price markup calculators, each with unique features and functionalities. Understanding these variations can help businesses choose the calculator that best aligns with their specific needs:

- Basic Markup Calculators: These calculators provide a simple and straightforward way to calculate selling prices based on cost and markup percentage. They typically offer a single input field for each parameter and display the calculated selling price.

-

Advanced Markup Calculators: These calculators offer additional features and functionalities, such as:

- Multiple Product Support: Allowing businesses to calculate selling prices for multiple products simultaneously.

- Customizable Markup Percentages: Enabling businesses to set different markup percentages for different products or categories.

- Cost Analysis: Providing insights into the breakdown of costs and their impact on selling prices.

- Profit Margin Calculation: Displaying the projected profit margin for each product.

- Integrated Markup Calculators: These calculators are often incorporated into accounting software or e-commerce platforms. They streamline the pricing process by automatically pulling data from other systems and providing seamless integration with existing business workflows.

Choosing the Right Price Markup Calculator for Your Business

Selecting the appropriate price markup calculator depends on several factors, including:

- Business Size: Small businesses may find a basic calculator sufficient, while larger businesses with complex pricing structures may require advanced features.

- Industry: Different industries have varying pricing dynamics, and some calculators may be better suited for specific sectors.

- Budget: Basic calculators are typically free or available at a low cost, while advanced calculators may involve a subscription fee.

- Integration Needs: Businesses with existing accounting software or e-commerce platforms should consider integrated calculators for seamless integration.

FAQs about Price Markup Calculators

1. How do I determine the right markup percentage?

The ideal markup percentage varies depending on factors such as industry, competition, product value, and desired profit margin. Researching industry benchmarks, analyzing competitor pricing, and considering the cost of goods sold are crucial steps in determining an appropriate markup.

2. What are the limitations of using a price markup calculator?

While price markup calculators offer significant benefits, they are not a substitute for strategic pricing decisions. They should be used as a tool to support informed decision-making, considering factors beyond cost and markup, such as market demand, customer value, and competitor pricing.

3. Can I use a price markup calculator for service businesses?

Yes, price markup calculators can be used for service businesses as well. The cost of goods sold for services includes labor, materials, and overhead expenses. By applying a markup percentage, businesses can determine their service fees.

4. How do I adjust the markup percentage for different products?

Some price markup calculators allow for customizable markup percentages for different products or categories. This enables businesses to adjust pricing based on factors such as product value, cost structure, and market demand.

5. Is it better to use a fixed markup or a variable markup?

The choice between a fixed markup and a variable markup depends on the specific business context. A fixed markup provides consistency and simplifies pricing, while a variable markup allows for greater flexibility in adjusting prices based on factors such as product cost, competition, and market demand.

Tips for Effective Utilization of Price Markup Calculators

- Start with accurate cost data: Ensure that the cost of goods sold data entered into the calculator is accurate and reflects the true cost of producing or acquiring the product or service.

- Consider all relevant costs: Include all direct and indirect costs, such as labor, materials, overhead, and marketing expenses, when calculating the cost of goods sold.

- Analyze industry benchmarks: Research industry average markup percentages to gain insights into competitive pricing practices.

- Experiment with different markup percentages: Use the calculator to test different markup percentages and analyze their impact on selling prices and profit margins.

- Monitor competitor pricing: Regularly track competitor pricing to ensure that your markup percentages remain competitive.

- Adjust pricing based on market dynamics: Be prepared to adjust markup percentages in response to changes in market demand, competition, and economic conditions.

Conclusion

Price markup calculators are indispensable tools for businesses seeking to streamline their pricing strategies and optimize profitability. By automating the calculation of selling prices, these calculators enhance accuracy, improve efficiency, and facilitate data-driven pricing decisions. While they should not be solely relied upon, they provide a valuable foundation for informed pricing strategies, ensuring that businesses can effectively navigate the complexities of the market and achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Demystifying the Price Markup Calculator: A Comprehensive Guide for Businesses. We thank you for taking the time to read this article. See you in our next article!