Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel

Related Articles: Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel

- 2 Introduction

- 3 Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel

- 3.1 Understanding the Fundamentals of Price Markup

- 3.2 Implementing Price Markup Formula in Excel

- 3.3 Benefits of Using Price Markup Formula in Excel

- 3.4 Beyond the Basic Formula: Advanced Considerations

- 3.5 FAQs: Addressing Common Concerns

- 3.6 Tips for Effective Price Markup Formula Implementation

- 3.7 Conclusion: Unlocking Profitability Through Effective Pricing

- 4 Closure

Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel

In the competitive world of business, understanding the nuances of pricing is paramount. Setting the right price point is a delicate balancing act, ensuring both profitability and customer satisfaction. A crucial tool in this process is the price markup formula, which allows businesses to calculate a selling price that covers costs and generates a desired profit margin. Excel, with its powerful spreadsheet capabilities, provides an efficient platform for implementing this formula and achieving optimal pricing strategies.

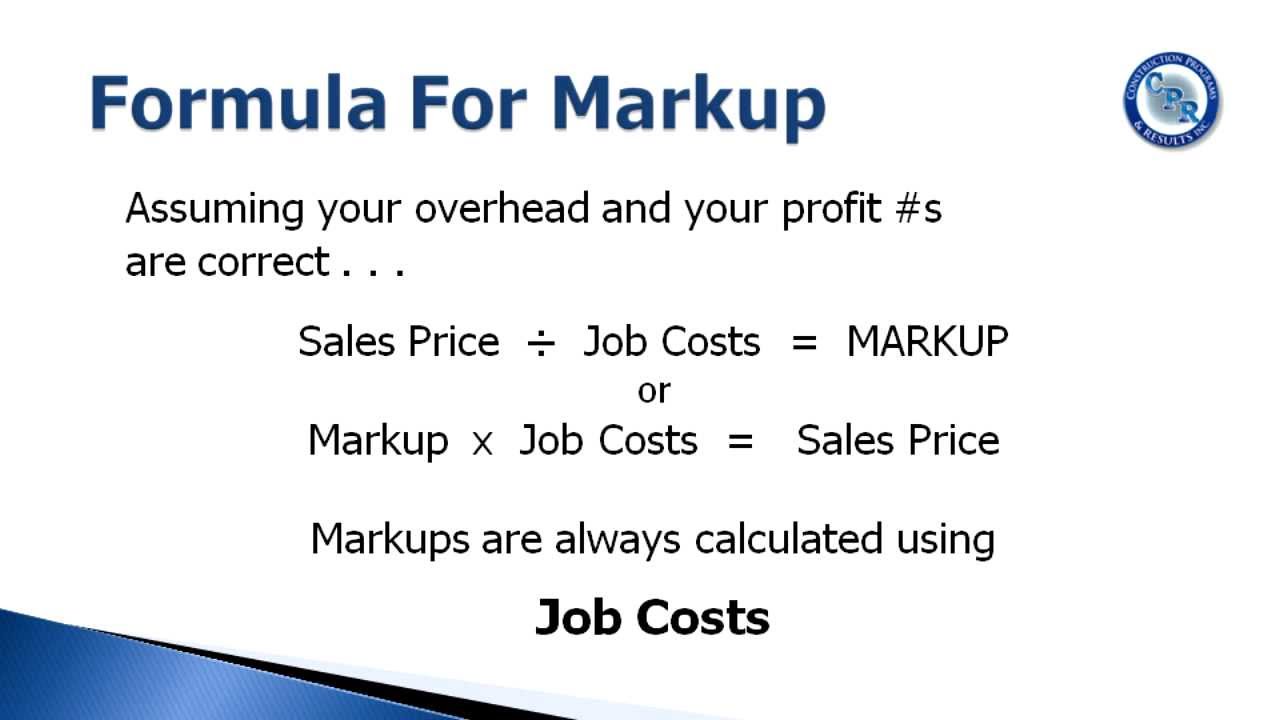

Understanding the Fundamentals of Price Markup

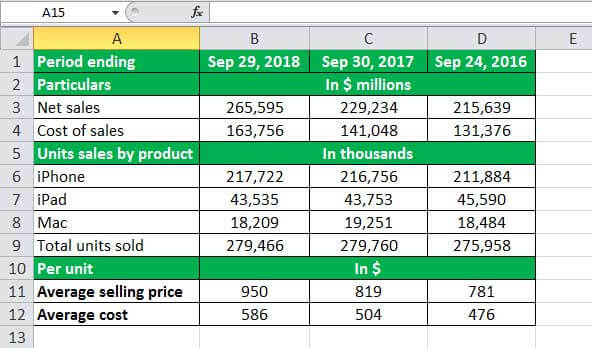

At its core, the price markup formula is a simple yet effective calculation that determines the selling price of a product or service by adding a percentage markup to its cost. This markup represents the profit margin that a business aims to achieve. The formula can be expressed as:

Selling Price = Cost + (Cost x Markup Percentage)

Cost: This represents the total expenses incurred in producing or acquiring a product or service. It includes direct costs like materials and labor, as well as indirect costs like overhead and marketing.

Markup Percentage: This is the percentage added to the cost to determine the selling price. It reflects the desired profit margin and is often influenced by industry standards, competitor pricing, and market demand.

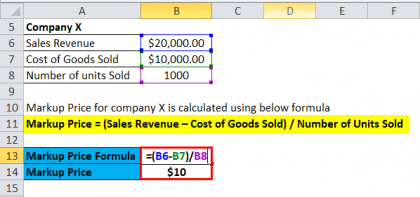

Implementing Price Markup Formula in Excel

Excel offers a user-friendly environment for calculating price markups, allowing businesses to streamline the process and analyze different pricing scenarios. Here’s a step-by-step guide:

-

Set up the Spreadsheet: Create a new spreadsheet and label the columns appropriately. For example:

- Column A: Product/Service Name

- Column B: Cost

- Column C: Markup Percentage

- Column D: Selling Price

-

Input Data: Enter the cost and markup percentage for each product or service in the corresponding columns.

-

Apply the Formula: In the "Selling Price" column (Column D), use the following formula:

=B2+(B2*C2)This formula calculates the selling price by adding the cost (B2) to the product of the cost and markup percentage (B2*C2).

-

Copy the Formula: Copy the formula down the column to calculate the selling price for all products or services.

Benefits of Using Price Markup Formula in Excel

Employing the price markup formula in Excel offers numerous advantages, streamlining pricing processes and enhancing business decision-making:

- Efficiency: Excel’s automation capabilities significantly reduce the time and effort involved in calculating selling prices, allowing for quick and accurate results.

- Flexibility: The formula can be easily modified to accommodate different cost structures and markup percentages, providing flexibility to adjust pricing strategies based on changing market conditions.

- Scenario Analysis: Excel’s functionality allows businesses to analyze various pricing scenarios by altering the markup percentage and observing the impact on selling prices and profit margins.

- Transparency: The formula provides a clear and transparent calculation of selling prices, facilitating communication and understanding within the organization.

- Data Visualization: Excel’s charting capabilities enable businesses to visualize pricing data and identify trends, providing valuable insights for pricing decisions.

Beyond the Basic Formula: Advanced Considerations

While the basic price markup formula provides a solid foundation for pricing, businesses often need to consider more sophisticated factors to optimize their pricing strategies. Excel’s advanced features can be leveraged to incorporate these considerations:

- Variable Markup Percentages: Different products or services may require different markup percentages depending on factors like cost structure, market demand, and competitive landscape. Excel allows for assigning unique markup percentages to each item.

- Dynamic Pricing: Market conditions can fluctuate, requiring businesses to adjust their pricing accordingly. Excel enables dynamic pricing by incorporating formulas that automatically update selling prices based on factors like cost changes, competitor pricing, or seasonal demand.

- Cost-Plus Pricing: This method adds a fixed markup to the cost of each unit, ensuring that the business recovers its costs and generates a predetermined profit margin. Excel can be used to calculate cost-plus pricing based on specific cost components and desired profit margins.

- Value-Based Pricing: This approach focuses on the perceived value of a product or service to customers, rather than solely on cost. Excel can be used to analyze customer segmentation, market research data, and competitor pricing to determine a value-based pricing strategy.

FAQs: Addressing Common Concerns

1. How does markup percentage differ from profit margin?

Markup percentage is calculated as a percentage of the cost, while profit margin is calculated as a percentage of the selling price. While both metrics relate to profitability, understanding the difference is crucial for accurate pricing decisions.2. What factors should be considered when setting the markup percentage?

Factors to consider include:

* **Cost of Goods Sold (COGS):** The direct costs associated with producing or acquiring a product or service.

* **Operating Expenses:** Indirect costs like rent, utilities, and salaries.

* **Desired Profit Margin:** The target profit percentage that the business aims to achieve.

* **Competitive Landscape:** Pricing strategies employed by competitors.

* **Market Demand:** The willingness of customers to pay a certain price for the product or service.3. Can Excel be used to calculate discounts and promotions?

Yes, Excel can be used to calculate discounts and promotions by incorporating formulas that adjust the selling price based on specific criteria. For example, a formula can be used to apply a percentage discount to items purchased in bulk or during promotional periods.4. What are some common pricing strategies that can be implemented in Excel?

Common pricing strategies include:

* **Cost-Plus Pricing:** Adding a fixed markup to the cost of each unit.

* **Value-Based Pricing:** Setting prices based on the perceived value of the product or service to customers.

* **Competitive Pricing:** Matching or slightly undercutting competitor prices.

* **Premium Pricing:** Charging a higher price for products or services perceived as superior in quality or value.

* **Penetration Pricing:** Setting a low price to gain market share and discourage competition.Tips for Effective Price Markup Formula Implementation

- Regularly Review Costs: Ensure that the cost data used in the formula is accurate and up-to-date, as cost fluctuations can significantly impact pricing decisions.

- Track Competitor Pricing: Monitor competitor pricing strategies to ensure that your pricing remains competitive and attracts customers.

- Analyze Market Demand: Conduct market research to understand customer preferences and willingness to pay, informing pricing decisions.

- Experiment with Different Scenarios: Use Excel’s functionality to analyze various pricing scenarios and identify the most profitable options.

- Seek Professional Advice: Consult with financial experts or pricing consultants to gain insights and guidance on pricing strategies.

Conclusion: Unlocking Profitability Through Effective Pricing

The price markup formula in Excel empowers businesses to make informed pricing decisions, driving profitability and achieving business objectives. By leveraging Excel’s capabilities for calculation, analysis, and visualization, businesses can effectively manage their pricing strategies, ensuring that they are both competitive and profitable in the marketplace. Understanding the fundamentals of price markup, implementing the formula in Excel, and considering advanced pricing strategies will equip businesses with the tools they need to navigate the complexities of pricing and achieve sustainable growth.

![Excel Formula to Add Percentage Markup [with Calculator] - ExcelDemy](https://www.exceldemy.com/wp-content/uploads/2019/01/7.add-markup-percentage.png)

Closure

Thus, we hope this article has provided valuable insights into Mastering the Art of Profitability: A Comprehensive Guide to Price Markup Formula in Excel. We hope you find this article informative and beneficial. See you in our next article!