Navigating the Complexities of Non-Standard Make-Up Claim Calculations

Related Articles: Navigating the Complexities of Non-Standard Make-Up Claim Calculations

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Non-Standard Make-Up Claim Calculations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Non-Standard Make-Up Claim Calculations

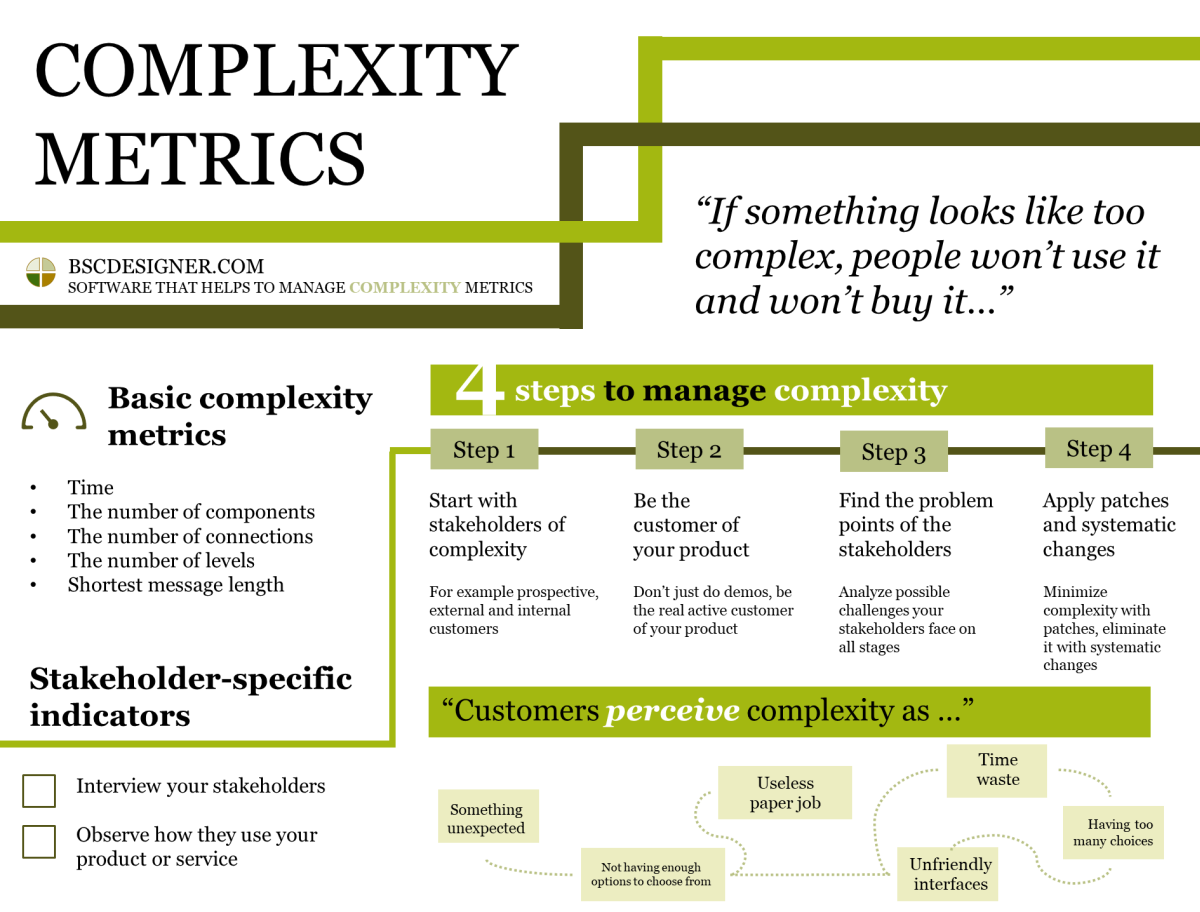

The realm of insurance claims can be intricate, particularly when dealing with non-standard situations. Non-standard make-up claims, often arising from unique circumstances or complex scenarios, necessitate a meticulous approach to calculation. This article aims to provide a comprehensive understanding of the processes involved in calculating such claims, highlighting the significance of accuracy and transparency in achieving fair and equitable outcomes.

Understanding Non-Standard Make-Up Claims

Before delving into the intricacies of calculation, it’s crucial to define the concept of non-standard make-up claims. These claims differ from standard claims in that they involve scenarios not covered by pre-defined formulas or conventional claim procedures. Examples include:

- Claims involving unique or specialized property: This could involve claims for antique furniture, artwork, or rare collectibles, where standard valuation methods may not apply.

- Claims with complex damage assessments: Situations where the extent of damage is difficult to quantify, such as in cases of fire or flood, may require specialized assessments and calculations.

- Claims with multiple contributing factors: When multiple events or circumstances contribute to the loss, determining the individual impact of each factor on the final claim amount can be challenging.

- Claims involving business interruption: Calculating the financial impact of a business interruption due to an insured event requires a thorough analysis of lost revenue and associated expenses.

The Importance of Accurate Non-Standard Claim Calculations

Accurate calculations are paramount in ensuring fair and equitable outcomes for both the insured and the insurer. A properly calculated non-standard claim:

- Protects the insured’s financial interests: By ensuring the insured receives the full amount of compensation for their loss, accurate calculations help mitigate financial hardship.

- Maintains the insurer’s financial stability: Accurate claim calculations prevent overpayments, protecting the insurer’s financial reserves and ensuring sustainable operations.

- Promotes trust and transparency: Transparent and demonstrably accurate calculations build trust between the insured and the insurer, fostering a positive relationship.

- Encourages fair and equitable outcomes: By ensuring that claims are calculated based on objective criteria, accurate calculations contribute to a fair and equitable claims process.

Key Steps in Calculating Non-Standard Make-Up Claims

Calculating non-standard make-up claims involves a multi-step process that demands careful attention to detail and a thorough understanding of the specific circumstances. Here’s a breakdown of the essential steps:

-

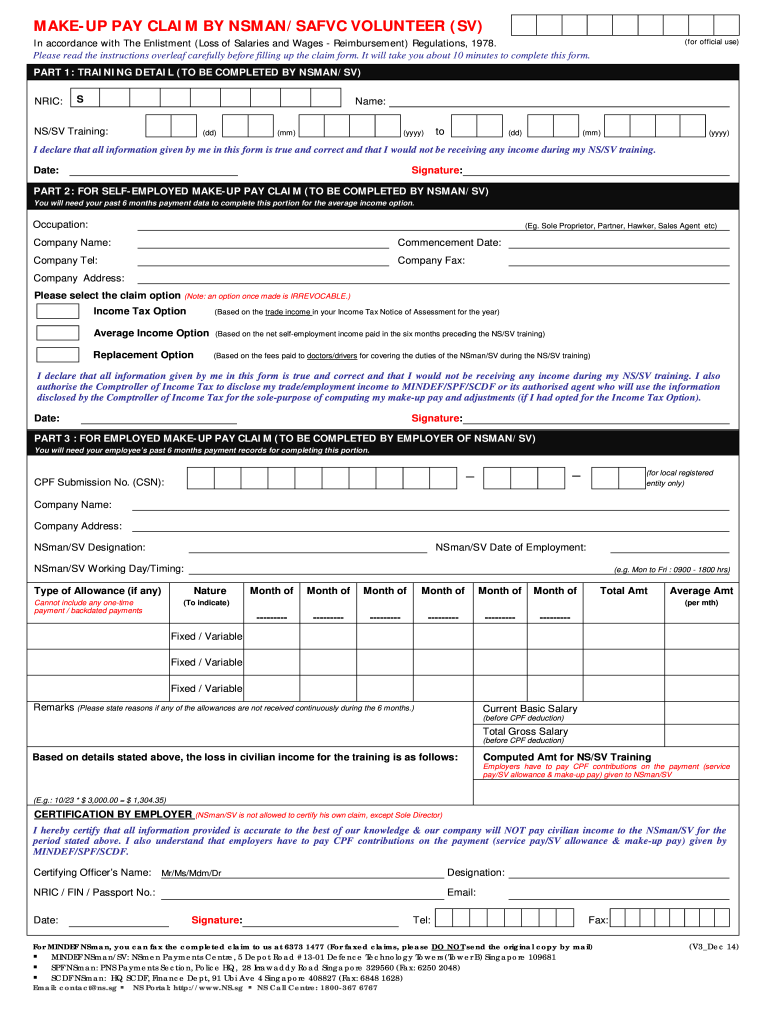

Detailed Investigation and Documentation: The first step is to thoroughly investigate the claim, gathering all relevant information and documentation. This includes:

- Policy Review: Understanding the specific terms and conditions of the insurance policy is crucial in determining coverage and applicable limits.

- Loss Assessment: A comprehensive assessment of the loss is essential, including the nature, extent, and cause of damage.

- Supporting Documentation: Collecting supporting documentation, such as receipts, invoices, photographs, and expert reports, is vital for substantiating the claim.

-

Valuation and Cost Determination: Once the loss is assessed, the next step is to determine the value of the damaged property or the financial impact of the loss. This may involve:

- Market Value Analysis: For tangible property, determining the market value based on comparable sales or expert appraisals is essential.

- Replacement Cost Analysis: Calculating the cost of replacing the damaged property with a new, similar item.

- Loss of Income Calculation: For business interruption claims, calculating lost revenue and additional expenses incurred due to the interruption.

-

Application of Relevant Formulas and Procedures: Depending on the specific nature of the claim and the policy terms, various formulas and procedures may be applied to calculate the final claim amount. This may include:

- Depreciation Calculations: Accounting for the depreciation of property over time, particularly for older items.

- Deductible Adjustments: Subtracting the policy deductible from the total claim amount.

- Co-Insurance Provisions: Adjusting the claim amount based on the insured’s adherence to co-insurance requirements.

-

Expert Consultations and Independent Verifications: In complex cases, seeking expert consultations or independent verifications can enhance the accuracy and transparency of the calculation process. This may involve:

- Appraisers: Independent appraisers can provide objective valuations of damaged property.

- Engineers: Structural engineers may be consulted for damage assessments in cases of fire or structural damage.

- Accountants: Accountants can assist in calculating lost revenue and expenses for business interruption claims.

-

Claim Review and Settlement: Once the calculations are completed, the claim is reviewed and a settlement offer is presented to the insured. This may involve:

- Negotiation: The insured and insurer may negotiate the final settlement amount, taking into account all relevant factors.

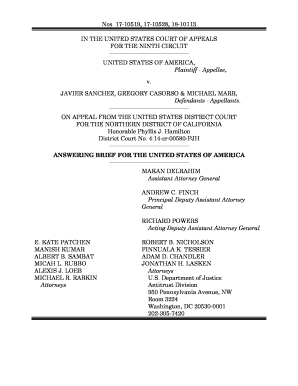

- Dispute Resolution: In cases of disagreement, alternative dispute resolution methods, such as mediation or arbitration, may be employed.

Frequently Asked Questions (FAQs) Regarding Non-Standard Make-Up Claim Calculations

1. What are some common examples of non-standard make-up claims?

Non-standard claims can arise from various situations, including:

- Claims involving unique or valuable items: Antique furniture, rare collectibles, or artwork often require specialized valuation methods.

- Claims with complex damage assessments: Fire, flood, or natural disasters can cause extensive damage that necessitates specialized assessments and calculations.

- Claims with multiple contributing factors: When multiple events contribute to the loss, determining the individual impact of each factor can be complex.

- Claims involving business interruption: Calculating the financial impact of a business interruption requires a thorough analysis of lost revenue and expenses.

2. How do insurers determine the value of damaged property in non-standard claims?

Insurers utilize various methods to determine the value of damaged property, including:

- Market Value Analysis: This involves researching comparable sales of similar items to establish a market value.

- Replacement Cost Analysis: This method calculates the cost of replacing the damaged property with a new, similar item.

- Expert Appraisals: Independent appraisers with specialized expertise can provide objective valuations of unique or valuable items.

3. What are the key considerations when calculating business interruption claims?

Calculating business interruption claims requires careful consideration of:

- Lost Revenue: Estimating the revenue that would have been generated during the period of interruption.

- Additional Expenses: Accounting for any additional expenses incurred due to the interruption, such as temporary relocation costs.

- Policy Limits: Understanding the limits of coverage for business interruption claims specified in the policy.

4. What role do experts play in non-standard claim calculations?

Experts, such as appraisers, engineers, and accountants, play a crucial role in ensuring the accuracy and transparency of non-standard claim calculations by:

- Providing objective assessments: Experts can provide impartial evaluations of the damage, value, or financial impact of the loss.

- Offering specialized expertise: Experts with specialized knowledge in specific areas, such as antiques or engineering, can provide valuable insights.

- Supporting the claims process: Expert reports and assessments can provide evidence and documentation to support the claim calculations.

5. What are the potential consequences of inaccurate non-standard claim calculations?

Inaccurate claim calculations can have significant consequences, including:

- Financial hardship for the insured: An underpaid claim can leave the insured facing financial difficulties.

- Financial strain on the insurer: Overpayments can deplete the insurer’s financial reserves, potentially leading to instability.

- Loss of trust and reputation: Inaccurate calculations can erode trust between the insured and the insurer, damaging the insurer’s reputation.

- Legal disputes: Inaccurate calculations can lead to disputes and potential legal action.

Tips for Navigating Non-Standard Make-Up Claim Calculations

- Thorough documentation: Maintain detailed records of the loss, including photographs, receipts, invoices, and expert reports.

- Clear communication: Communicate clearly with the insurer, providing all necessary information and documentation promptly.

- Seek expert advice: Consult with experts, such as appraisers or engineers, to ensure accurate assessments and valuations.

- Understand the policy terms: Review the insurance policy carefully to understand the coverage and limitations.

- Negotiate fairly: Be prepared to negotiate with the insurer to reach a fair settlement.

- Consider alternative dispute resolution: If a dispute arises, explore alternative dispute resolution methods, such as mediation or arbitration.

Conclusion

Navigating non-standard make-up claim calculations requires a meticulous approach, encompassing detailed investigation, accurate valuation, and the application of relevant formulas and procedures. By understanding the complexities involved and adhering to best practices, both insurers and insureds can contribute to a fair and equitable claims process, ensuring that claims are calculated accurately and transparently, promoting trust and protecting the interests of all parties involved. The emphasis on accuracy, transparency, and fairness remains paramount in achieving equitable outcomes for all stakeholders within the insurance landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Non-Standard Make-Up Claim Calculations. We thank you for taking the time to read this article. See you in our next article!