Navigating the Labyrinth: A Comprehensive Guide to Understanding and Calculating Insurance Claims

Related Articles: Navigating the Labyrinth: A Comprehensive Guide to Understanding and Calculating Insurance Claims

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Labyrinth: A Comprehensive Guide to Understanding and Calculating Insurance Claims. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: A Comprehensive Guide to Understanding and Calculating Insurance Claims

In the realm of insurance, the process of filing and settling claims is a critical aspect that directly impacts both the insured and the insurer. This intricate process involves a meticulous assessment of the claim, determining the extent of the loss, and ultimately arriving at a fair compensation amount. This guide delves into the intricacies of calculating insurance claims, focusing on the essential factors that contribute to a precise and equitable outcome.

Understanding the Fundamentals of Insurance Claims

Insurance claims represent the financial compensation that an insured party receives from the insurer when an insured event occurs. This event could range from a car accident to a house fire, or even a medical emergency. The foundation of any insurance claim rests on the policy agreement, which outlines the specific coverage, terms, and conditions. This agreement serves as a roadmap for both the insured and the insurer, guiding the claim process and ensuring transparency throughout.

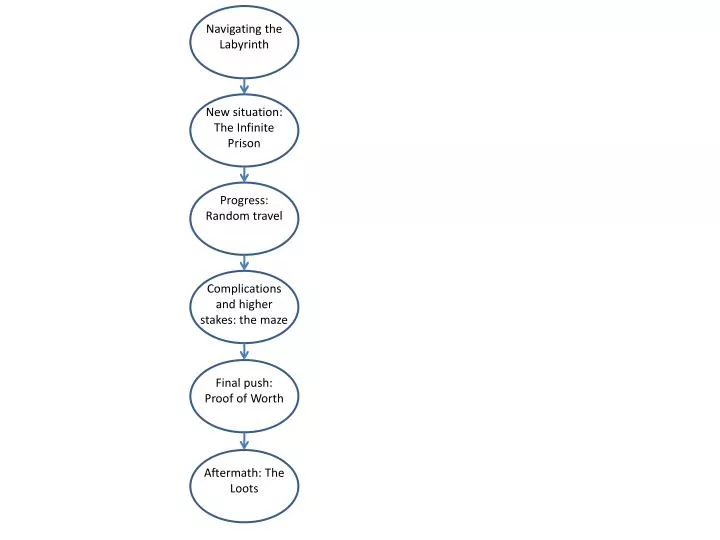

The Claim Calculation Process: A Step-by-Step Breakdown

The calculation of an insurance claim involves a systematic and methodical approach, ensuring that the final compensation accurately reflects the incurred loss. This process typically entails the following steps:

-

Claim Reporting and Investigation: The process begins with the insured reporting the claim to the insurer. This is followed by a thorough investigation by the insurer to gather evidence and verify the details of the claim. This may involve inspecting the damaged property, interviewing witnesses, and reviewing relevant documentation.

-

Loss Assessment and Valuation: Once the investigation is complete, the insurer proceeds to assess the extent of the loss. This involves determining the value of the damaged property, considering factors such as age, condition, and market value. In cases of personal injury claims, medical records, treatment costs, and lost income are meticulously reviewed to establish the extent of the injury and its financial impact.

-

Deductible and Co-insurance: The policy typically includes a deductible, which is the initial amount the insured is responsible for paying before the insurer begins covering the remaining costs. Similarly, co-insurance provisions may require the insured to share a percentage of the covered expenses. These elements are deducted from the total loss amount to determine the final compensation.

-

Policy Limits and Exclusions: The policy also defines the maximum coverage limits for specific events and outlines specific exclusions that are not covered. The final compensation amount cannot exceed the policy limits, and any losses arising from excluded events are not eligible for reimbursement.

-

Claim Settlement and Payment: Once the claim calculation is finalized, the insurer issues a settlement offer to the insured. This offer outlines the final compensation amount and details the payment terms. The insured can either accept the offer or negotiate for a higher amount. Upon acceptance, the insurer processes the payment, either through a direct deposit or a check.

Factors Influencing Claim Calculation

The final compensation amount for an insurance claim is influenced by a multitude of factors, each playing a crucial role in determining the fair value of the loss. These factors include:

-

Type of Insurance Policy: The type of insurance policy determines the scope of coverage and the specific events that are eligible for compensation. For instance, a homeowner’s insurance policy covers losses related to the dwelling, while an auto insurance policy covers losses related to a vehicle.

-

Policy Coverage: The policy coverage outlines the specific events and situations that are covered under the policy. This includes the maximum coverage limits for different types of losses and any specific exclusions.

-

Nature and Extent of the Loss: The nature and extent of the loss significantly impact the claim calculation. For instance, a minor car accident will result in a smaller compensation amount compared to a major accident that causes extensive damage.

-

Pre-existing Conditions: In cases of medical claims, pre-existing conditions can influence the compensation amount. If the injury or illness is related to a pre-existing condition, the insurer may consider it a pre-existing condition and limit the compensation accordingly.

-

Market Value and Depreciation: For property damage claims, the market value and depreciation of the damaged property are crucial factors in determining the compensation amount. The insurer will assess the property’s value at the time of the loss, taking into account depreciation due to age and wear and tear.

-

Proof of Loss: The insured is responsible for providing sufficient proof of loss to support the claim. This documentation may include receipts, invoices, medical records, and photographs of the damaged property. The quality and completeness of the documentation directly influence the claim calculation.

Navigating the Complexities: Tips for a Successful Claim

The claim calculation process can be complex, requiring careful attention to detail and a thorough understanding of the policy terms. The following tips can help navigate this process effectively:

-

Understand your Policy: Before filing a claim, thoroughly review your policy to understand the coverage, limits, and exclusions. This knowledge will empower you to accurately assess your potential claim and manage expectations.

-

Document Everything: Maintain detailed records of the incident, including dates, times, locations, and witness information. Gather relevant documentation, such as receipts, invoices, and photographs, to support your claim.

-

Report the Claim Promptly: Notify your insurer about the claim promptly after the incident. This will allow them to initiate the investigation and ensure a timely resolution.

-

Cooperate with the Insurer: Be transparent and cooperative with the insurer during the investigation process. Provide all requested information and documentation promptly to facilitate a smooth and efficient claim settlement.

-

Seek Professional Assistance: If you are unsure about any aspect of the claim process or have difficulty understanding the policy terms, seek professional assistance from an insurance agent, broker, or attorney.

Addressing Common Questions Regarding Claim Calculation

1. What happens if the insurer denies my claim?

If the insurer denies your claim, you have the right to appeal the decision. This involves providing additional documentation and evidence to support your claim and potentially seeking legal counsel to represent your interests.

2. How long does it take to settle a claim?

The time it takes to settle a claim varies depending on the complexity of the case and the insurer’s processing time. Simple claims may be settled within a few weeks, while more complex claims may take several months.

3. Can I negotiate the settlement amount?

Yes, you have the right to negotiate the settlement amount with the insurer. If you believe the offered amount is inadequate, you can present additional evidence and arguments to support your claim.

4. What if the claim exceeds my policy limits?

If the claim exceeds your policy limits, you will be responsible for covering the remaining expenses. Consider purchasing additional coverage or seeking alternative solutions to cover the excess amount.

5. How can I protect myself from future claims?

Maintaining a safe environment, practicing preventive measures, and ensuring proper maintenance of your property can help minimize the risk of future claims.

Conclusion: Empowering Informed Decision-Making

Navigating the world of insurance claims requires a comprehensive understanding of the calculation process, the factors that influence compensation, and the rights and responsibilities of both the insured and the insurer. By equipping yourself with this knowledge, you can ensure a fair and equitable resolution of your claims, safeguarding your financial well-being in the event of an unexpected loss.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: A Comprehensive Guide to Understanding and Calculating Insurance Claims. We hope you find this article informative and beneficial. See you in our next article!