OFMAS Bihar: A Comprehensive Guide to Enhancing Financial Inclusion

Related Articles: OFMAS Bihar: A Comprehensive Guide to Enhancing Financial Inclusion

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to OFMAS Bihar: A Comprehensive Guide to Enhancing Financial Inclusion. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

OFMAS Bihar: A Comprehensive Guide to Enhancing Financial Inclusion

Introduction

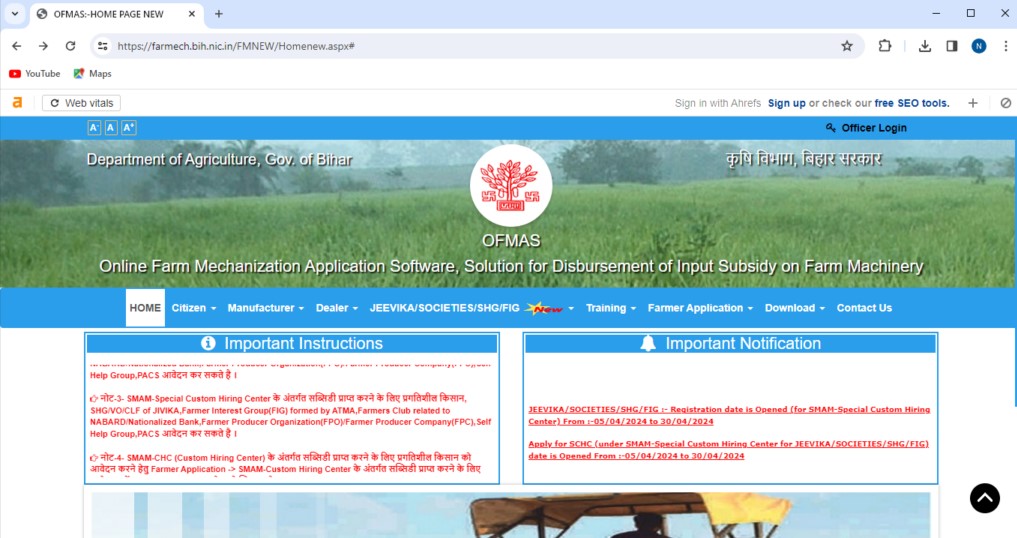

The Office of the Financial Inclusion and Microfinance Assistance Scheme (OFMAS) in Bihar plays a pivotal role in driving financial inclusion within the state. Established with the aim of empowering individuals and communities, OFMAS Bihar has been instrumental in promoting access to financial services, particularly for the underserved population. This comprehensive guide delves into the multifaceted aspects of OFMAS Bihar, exploring its objectives, initiatives, and impact on the state’s socio-economic landscape.

Understanding the Mandate of OFMAS Bihar

OFMAS Bihar operates under the aegis of the Department of Rural Development, Government of Bihar. Its primary mandate is to facilitate the delivery of financial services to the rural and marginalized sections of society. This encompasses a broad range of activities, including:

- Promoting Microfinance Institutions (MFIs): OFMAS Bihar fosters the growth of MFIs by providing them with necessary support, including capacity building, training, and access to resources.

- Developing Financial Literacy Programs: The organization plays a crucial role in educating individuals about financial products, services, and responsible financial management practices.

- Facilitating Access to Credit and Savings: OFMAS Bihar actively promotes access to credit and savings schemes, particularly for those who lack traditional banking relationships.

- Promoting Financial Inclusion Initiatives: The organization spearheads various initiatives aimed at expanding financial inclusion, such as promoting mobile banking and digital financial services.

Key Initiatives of OFMAS Bihar

OFMAS Bihar has implemented several impactful initiatives to achieve its objectives. Some of the notable programs include:

- Bihar Rural Livelihoods Promotion Society (BRLPS): This initiative empowers rural women by providing them with access to microfinance, skill development training, and livelihood opportunities.

- Bihar State Rural Livelihoods Mission (BSRLM): This program aims to improve the livelihoods of rural communities by promoting self-help groups, micro-enterprises, and financial inclusion.

- Financial Literacy Programs: OFMAS Bihar conducts regular workshops and training sessions to enhance the financial literacy of individuals and communities. These programs cover topics such as budgeting, savings, credit management, and insurance.

- Digital Financial Services: The organization actively promotes the adoption of digital financial services, such as mobile banking and e-wallets, to enhance convenience and accessibility.

Impact of OFMAS Bihar on the State

The efforts of OFMAS Bihar have demonstrably contributed to improved financial inclusion and socio-economic progress in Bihar. Its initiatives have resulted in:

- Increased Access to Financial Services: A significant number of individuals, particularly in rural areas, have gained access to credit, savings, and insurance products through OFMAS Bihar’s programs.

- Empowerment of Women: The organization’s initiatives have empowered women by providing them with financial independence and opportunities for economic growth.

- Improved Livelihoods: OFMAS Bihar’s programs have directly contributed to improving livelihoods by fostering the growth of micro-enterprises and providing access to resources.

- Reduced Poverty: By promoting financial inclusion and access to credit, OFMAS Bihar has played a crucial role in reducing poverty levels in the state.

FAQs on OFMAS Bihar

Q1: What are the eligibility criteria for availing financial services through OFMAS Bihar?

A1: The eligibility criteria for availing financial services through OFMAS Bihar vary depending on the specific program or scheme. However, generally, individuals must be residents of Bihar and meet the income and other requirements set by the respective program.

Q2: How can I apply for a loan through OFMAS Bihar?

A2: To apply for a loan through OFMAS Bihar, you need to approach a registered MFI or a partner institution. They will guide you through the application process and provide necessary information.

Q3: What are the interest rates on loans offered by OFMAS Bihar?

A3: The interest rates on loans offered by OFMAS Bihar are typically lower than those offered by traditional banks and are designed to be affordable for low-income individuals.

Q4: What are the key challenges faced by OFMAS Bihar?

A4: OFMAS Bihar faces challenges such as limited financial resources, lack of awareness about financial products and services, and the need to reach remote and underserved areas effectively.

Q5: How can I contribute to OFMAS Bihar’s mission?

A5: You can contribute to OFMAS Bihar’s mission by spreading awareness about financial inclusion, volunteering for their programs, or donating to support their initiatives.

Tips for Beneficiaries of OFMAS Bihar

- Understand the Terms and Conditions: Carefully read and understand the terms and conditions of any financial product or service you avail through OFMAS Bihar.

- Maintain a Good Credit History: Building a good credit history is essential for accessing financial services in the future. Make timely repayments on loans and other financial obligations.

- Utilize Financial Literacy Programs: Participate in financial literacy programs offered by OFMAS Bihar to enhance your knowledge about managing finances effectively.

- Seek Guidance from MFIs: Consult with registered MFIs for guidance and support in accessing and utilizing financial services.

Conclusion

OFMAS Bihar stands as a testament to the government’s commitment to promoting financial inclusion and empowering individuals, particularly in rural areas. Its initiatives have played a significant role in improving livelihoods, reducing poverty, and fostering economic growth in the state. As the organization continues to evolve and adapt to the changing needs of the community, it remains a vital force in driving financial inclusion and creating a more equitable society in Bihar.

[1].webp)

Closure

Thus, we hope this article has provided valuable insights into OFMAS Bihar: A Comprehensive Guide to Enhancing Financial Inclusion. We thank you for taking the time to read this article. See you in our next article!