The Evolution of OFMAS: From Traditional to Modern Financial Management

Related Articles: The Evolution of OFMAS: From Traditional to Modern Financial Management

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolution of OFMAS: From Traditional to Modern Financial Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolution of OFMAS: From Traditional to Modern Financial Management

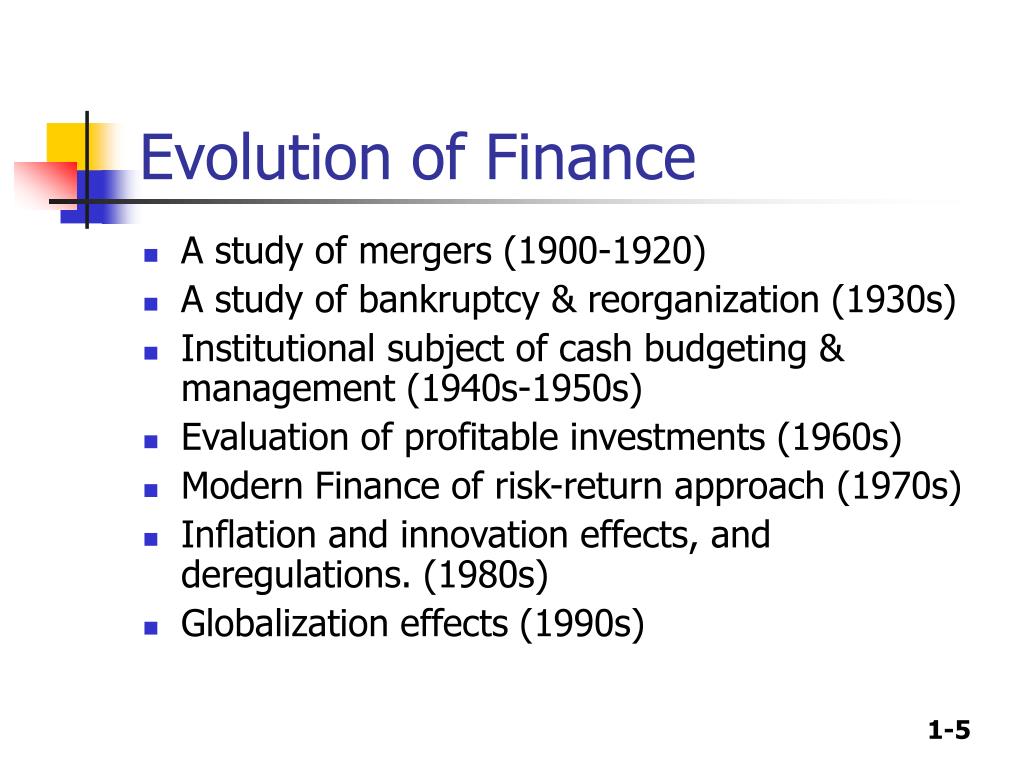

The landscape of financial management has undergone a significant transformation, fueled by technological advancements and evolving business needs. At the heart of this evolution lies the concept of "OFMAS" – "Online Financial Management and Accounting System". This article delves into the intricacies of OFMAS, exploring its historical roots, its modern-day applications, and its transformative impact on businesses across various sectors.

Understanding the Genesis of OFMAS

The origins of OFMAS can be traced back to the early days of computing, when businesses began experimenting with automating their accounting processes. The initial iterations of these systems were primarily focused on streamlining basic tasks like data entry and generating reports. However, as technology progressed and internet access became more widespread, the potential of financial management systems expanded exponentially.

The Rise of OFMAS: Embracing the Digital Revolution

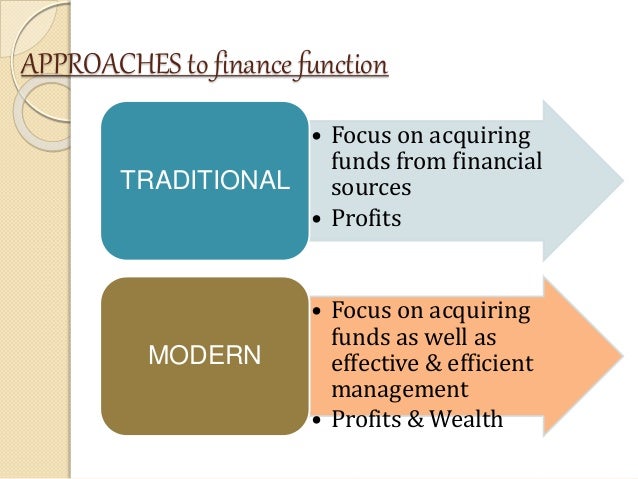

The advent of the internet and cloud computing ushered in a new era of financial management. OFMAS emerged as a comprehensive solution, integrating various financial functions into a single, accessible platform. This shift from traditional, on-premise systems to cloud-based platforms offered businesses numerous advantages:

- Accessibility: OFMAS systems can be accessed from any device with an internet connection, enabling remote work and real-time collaboration.

- Scalability: Cloud-based platforms can easily accommodate growing business needs, scaling up or down as required, without the need for significant hardware investments.

- Cost-effectiveness: OFMAS eliminates the need for expensive hardware, software licenses, and IT maintenance, resulting in significant cost savings.

- Real-time Data: OFMAS provides instant access to up-to-date financial data, empowering businesses to make informed decisions based on accurate information.

- Improved Efficiency: Automation of tasks like data entry, reconciliation, and reporting streamlines workflows, freeing up valuable time for strategic financial analysis.

- Enhanced Security: Cloud providers invest heavily in robust security measures, protecting sensitive financial data from cyber threats.

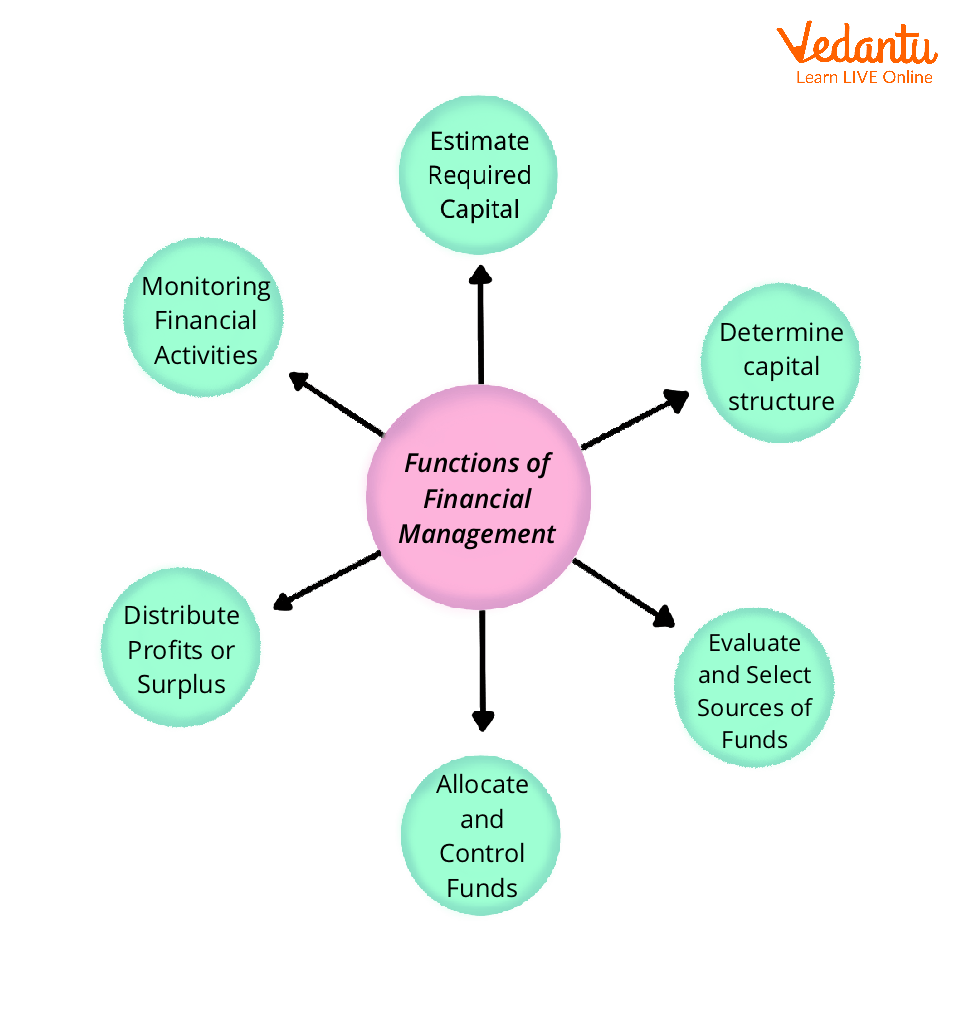

Components of a Modern OFMAS

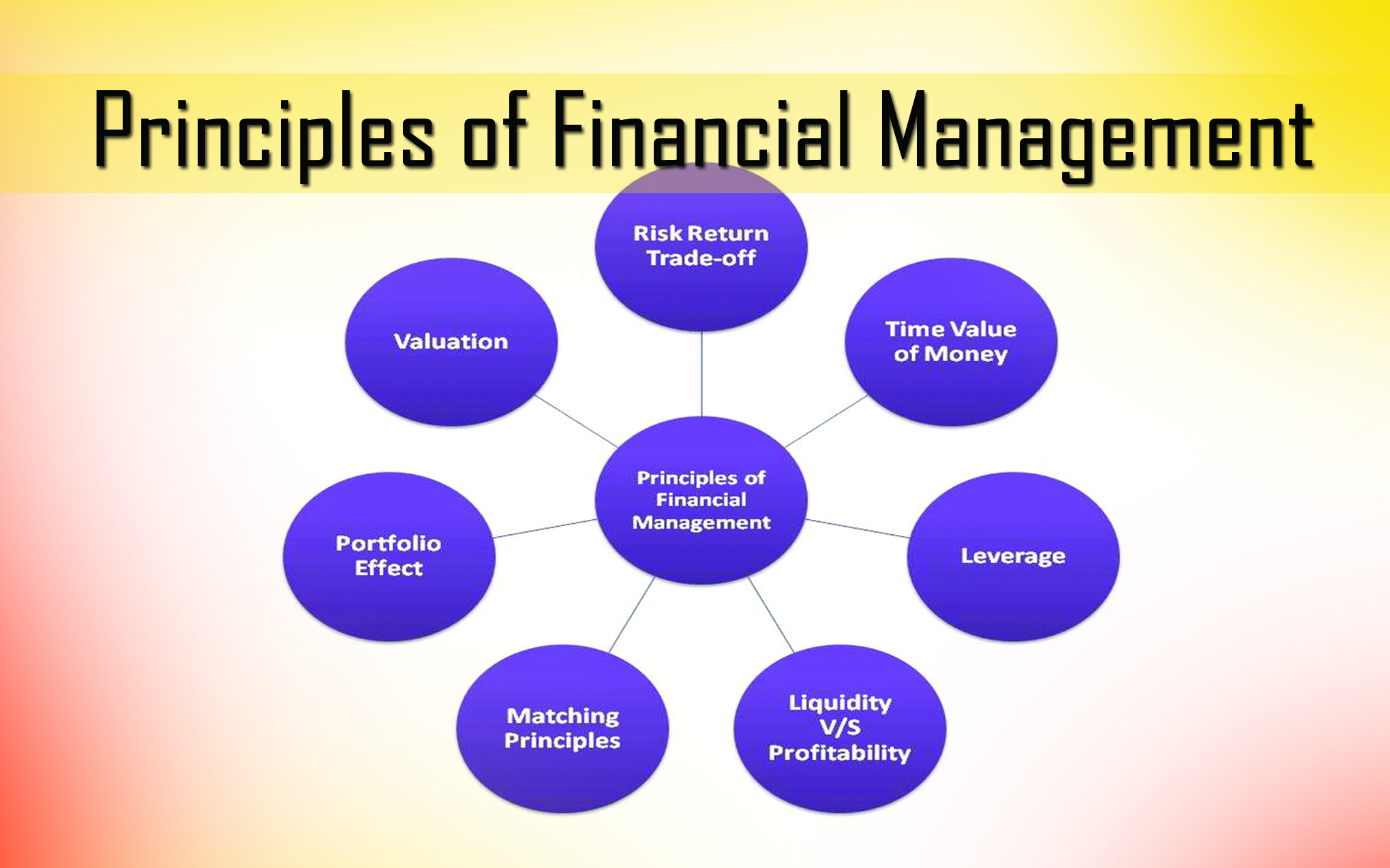

A modern OFMAS encompasses a wide range of functionalities designed to manage all aspects of a business’s financial operations. These functionalities typically include:

- Accounting: Managing accounts payable, accounts receivable, general ledger, and financial reporting.

- Budgeting and Forecasting: Creating budgets, tracking expenses, and forecasting future financial performance.

- Inventory Management: Tracking inventory levels, managing stock orders, and controlling costs.

- Payroll Processing: Calculating and distributing payroll, managing employee benefits, and complying with tax regulations.

- Tax Compliance: Preparing tax returns, managing tax liabilities, and ensuring compliance with relevant tax laws.

- Financial Reporting: Generating customized financial reports, analyzing financial performance, and identifying areas for improvement.

- Data Analytics: Leveraging data visualization tools to analyze financial trends, identify patterns, and make informed decisions.

Benefits of Implementing OFMAS

The implementation of an OFMAS system offers numerous benefits to businesses of all sizes, including:

- Improved Financial Visibility: Real-time access to financial data provides a clear picture of the organization’s financial health.

- Enhanced Decision-Making: Accurate and timely financial information empowers better strategic decision-making.

- Increased Efficiency: Automation of tasks frees up time and resources for more strategic initiatives.

- Reduced Costs: Eliminating manual processes and reducing errors leads to significant cost savings.

- Improved Compliance: Automated compliance features ensure adherence to relevant regulations and minimize the risk of penalties.

- Enhanced Security: Robust security measures protect sensitive financial data from unauthorized access.

- Streamlined Operations: Integrating financial functions into a single platform simplifies workflows and enhances collaboration.

Industries Embracing OFMAS

The transformative potential of OFMAS has been recognized across various industries, leading to its widespread adoption. Some key sectors where OFMAS plays a critical role include:

- Manufacturing: Managing inventory, controlling production costs, and tracking financial performance.

- Retail: Managing inventory, processing sales transactions, and analyzing customer spending patterns.

- Healthcare: Managing patient billing, tracking expenses, and complying with healthcare regulations.

- Education: Managing student fees, tracking expenses, and generating financial reports.

- Non-Profit Organizations: Managing donations, tracking expenses, and ensuring financial transparency.

- Government Agencies: Managing public funds, tracking expenditures, and generating financial reports.

The Future of OFMAS: Emerging Trends

The future of OFMAS is characterized by continuous innovation and the integration of emerging technologies. Some key trends shaping the future of financial management include:

- Artificial Intelligence (AI): AI-powered systems can automate complex tasks, analyze large datasets, and provide real-time insights into financial performance.

- Machine Learning (ML): ML algorithms can identify patterns and predict future financial trends, enabling businesses to make proactive decisions.

- Blockchain Technology: Blockchain offers a secure and transparent platform for managing financial transactions, reducing fraud and enhancing accountability.

- Internet of Things (IoT): IoT devices can collect real-time data on business operations, providing valuable insights into financial performance.

- Cloud-Based Integration: Seamless integration of OFMAS with other business applications, such as CRM and ERP systems, streamlines workflows and enhances data sharing.

FAQs about OFMAS

Q: What are the key considerations when choosing an OFMAS system?

A: Choosing the right OFMAS system involves evaluating factors such as:

- Business Needs: Identify the specific financial functions that need to be automated.

- Scalability: Ensure the system can accommodate future growth and expansion.

- Integration: Assess the system’s ability to integrate with existing business applications.

- Security: Verify the system’s security features and compliance with industry standards.

- Cost: Compare pricing models and ensure the system fits within the budget.

- Support: Evaluate the vendor’s customer support and training options.

Q: What are the common challenges associated with implementing an OFMAS system?

A: Implementing an OFMAS system can present challenges such as:

- Data Migration: Transferring existing financial data to the new system.

- User Training: Ensuring all users are adequately trained on the system’s functionalities.

- Integration with Existing Systems: Connecting the OFMAS system with other business applications.

- Change Management: Overcoming resistance to change and encouraging user adoption.

Q: How can businesses maximize the benefits of an OFMAS system?

A: Maximizing the benefits of an OFMAS system requires:

- Clear Objectives: Defining specific goals for implementing the system.

- Proper Training: Ensuring all users are adequately trained on the system’s functionalities.

- Data Accuracy: Maintaining accurate and up-to-date financial data.

- Regular Monitoring: Tracking system performance and identifying areas for improvement.

- Continuous Improvement: Regularly evaluating and updating the system to meet evolving business needs.

Tips for Successful OFMAS Implementation

- Involve Key Stakeholders: Engage key stakeholders in the decision-making process to ensure buy-in and support.

- Define Clear Goals: Establish specific, measurable, achievable, relevant, and time-bound objectives for the implementation.

- Choose the Right Vendor: Thoroughly research and select a vendor with a proven track record and a strong commitment to customer support.

- Implement in Phases: Phased implementation allows for gradual adoption and minimizes disruption to business operations.

- Provide Adequate Training: Invest in comprehensive training programs to ensure users are comfortable with the system.

- Monitor and Evaluate: Regularly monitor system performance, identify areas for improvement, and make necessary adjustments.

Conclusion

OFMAS has revolutionized financial management, empowering businesses to streamline operations, improve efficiency, and make data-driven decisions. The future of financial management is inextricably linked to the continuous evolution of OFMAS, as emerging technologies like AI, ML, and blockchain continue to transform the way businesses manage their finances. By embracing the power of OFMAS, businesses can unlock significant competitive advantages and navigate the complexities of the modern financial landscape with confidence.

Closure

Thus, we hope this article has provided valuable insights into The Evolution of OFMAS: From Traditional to Modern Financial Management. We appreciate your attention to our article. See you in our next article!