The S&P 500: A Foundation for Investment and Economic Insight

Related Articles: The S&P 500: A Foundation for Investment and Economic Insight

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The S&P 500: A Foundation for Investment and Economic Insight. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The S&P 500: A Foundation for Investment and Economic Insight

The S&P 500, a widely recognized stock market index, serves as a benchmark for the performance of large-cap U.S. equities. It comprises 500 of the largest publicly traded companies in the United States, representing a diverse array of sectors and industries. This index is a cornerstone of the financial world, offering valuable insights into the overall health of the American economy and providing a framework for investment strategies.

Understanding the S&P 500’s Composition

The S&P 500 is not simply a random collection of companies. Its selection process is rigorous and based on a set of criteria designed to reflect the most significant and influential businesses in the U.S. market. These criteria include:

- Market capitalization: The index prioritizes companies with large market capitalizations, signifying their size and influence in their respective industries.

- Liquidity: The chosen companies must have readily tradable shares, ensuring a smooth flow of transactions within the index.

- Financial stability: Companies included in the S&P 500 must demonstrate consistent profitability and a healthy financial standing.

- Industry representation: The index aims to provide a broad representation of different sectors, including technology, healthcare, financials, consumer staples, and more.

This careful selection process ensures that the S&P 500 provides a robust and representative picture of the U.S. stock market.

Beyond the Index: The Significance of the S&P 500

The S&P 500 holds immense significance for a multitude of stakeholders:

- Investors: The index serves as a crucial tool for investment decisions. Investors can use its performance as a gauge for the overall market trend, identifying potential investment opportunities and managing risk.

- Financial institutions: The S&P 500 is a fundamental building block for various financial instruments, including exchange-traded funds (ETFs) and mutual funds. These instruments offer investors a convenient and diversified way to track the performance of the index.

- Economists and analysts: The S&P 500 provides a vital data point for economic analysis. Its performance can be correlated with broader economic indicators, offering insights into consumer confidence, inflation, and overall economic growth.

The S&P 500: A Window into the U.S. Economy

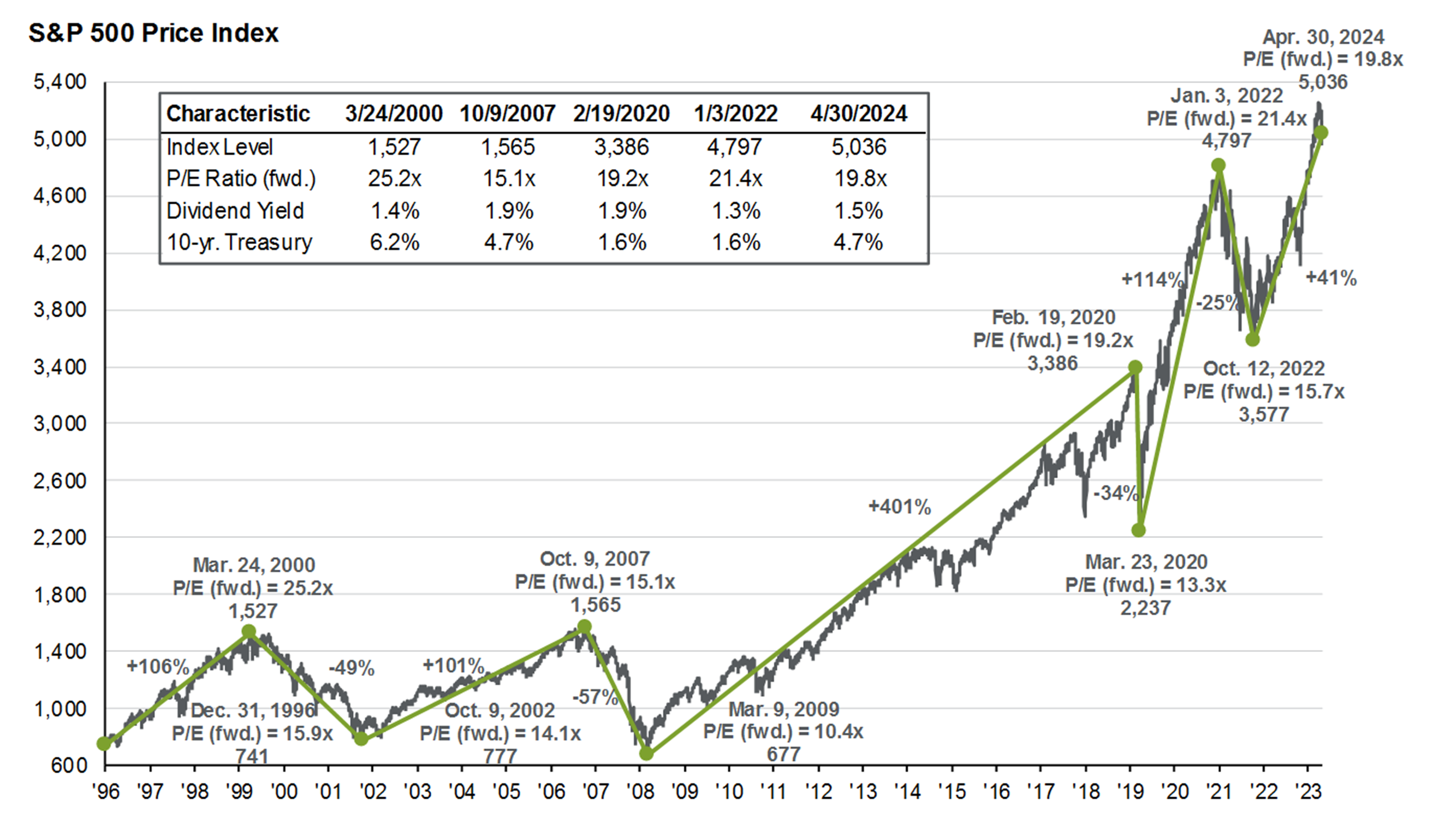

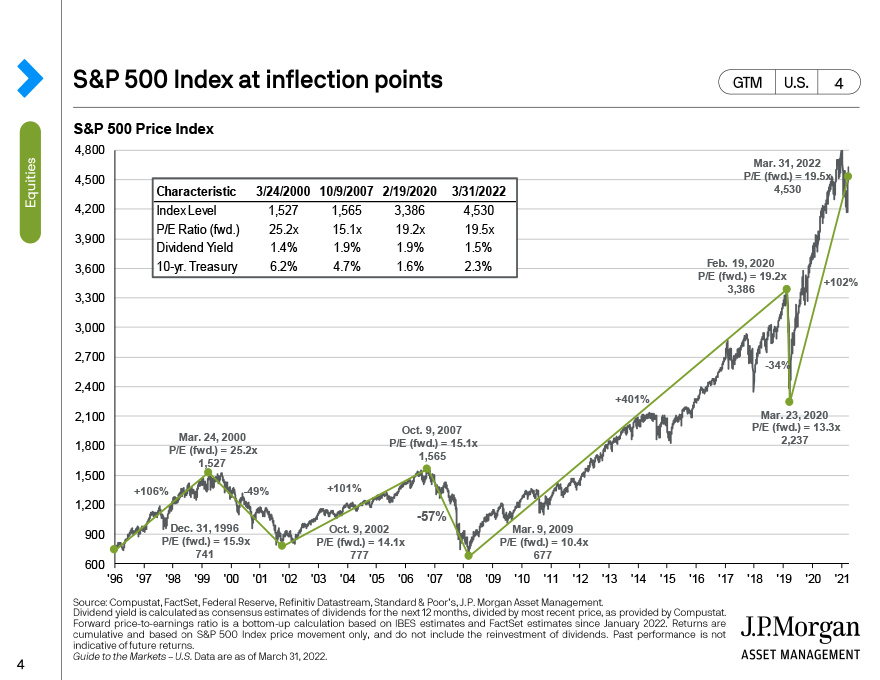

The index’s performance reflects the health of the U.S. economy in several ways:

- Economic growth: A rising S&P 500 often indicates a robust economy with strong corporate earnings and consumer spending.

- Inflation: Inflationary pressures can impact corporate profits and consumer spending, potentially leading to a decline in the S&P 500.

- Interest rates: Changes in interest rates can influence the cost of borrowing for businesses, impacting their profitability and the overall performance of the index.

- Global events: Geopolitical events, such as trade wars or international conflicts, can have a significant impact on the S&P 500, as they affect corporate operations and investor sentiment.

By closely monitoring the S&P 500, investors, economists, and policymakers can gain valuable insights into the current state of the U.S. economy and its potential trajectory.

FAQs about the S&P 500

1. How is the S&P 500 calculated?

The S&P 500 is a market-capitalization-weighted index. This means that the weighting of each company in the index is determined by its market capitalization, calculated by multiplying the company’s share price by the number of outstanding shares. Companies with larger market capitalizations have a greater influence on the index’s performance.

2. What are the benefits of investing in the S&P 500?

Investing in the S&P 500 offers several benefits:

- Diversification: The index includes companies from various sectors, providing investors with a diversified portfolio and reducing overall risk.

- Long-term growth potential: Historically, the S&P 500 has demonstrated strong long-term growth potential, outperforming other asset classes over extended periods.

- Accessibility: Investing in the S&P 500 is relatively easy and accessible through ETFs and mutual funds.

3. What are the risks associated with investing in the S&P 500?

While the S&P 500 offers significant benefits, it also carries certain risks:

- Market volatility: The stock market is inherently volatile, and the S&P 500 is no exception. Its performance can fluctuate significantly in the short term.

- Economic downturns: Economic recessions can negatively impact corporate earnings and lead to a decline in the S&P 500.

- Inflation: High inflation can erode the value of investments, including those in the S&P 500.

4. How can I invest in the S&P 500?

You can invest in the S&P 500 through:

- Exchange-traded funds (ETFs): These funds track the performance of the S&P 500 and trade on stock exchanges like regular stocks.

- Mutual funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks, often including S&P 500 companies.

- Individual stocks: You can also invest in individual companies listed in the S&P 500, but this approach requires more research and involves higher individual stock risk.

Tips for Investing in the S&P 500

- Do your research: Before investing, thoroughly understand the S&P 500, its composition, and the risks involved.

- Consider your investment goals: Determine your investment goals, risk tolerance, and time horizon before making any investment decisions.

- Choose a suitable investment vehicle: Select an investment vehicle that aligns with your investment goals and risk tolerance, such as ETFs, mutual funds, or individual stocks.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes and sectors.

- Invest for the long term: The stock market is inherently volatile. Invest with a long-term perspective, aiming to ride out market fluctuations and benefit from long-term growth.

Conclusion

The S&P 500 is a cornerstone of the financial world, offering a valuable benchmark for investors, financial institutions, and economists. Its composition reflects the strength and diversity of the U.S. economy, providing insights into its health and potential trajectory. While investing in the S&P 500 offers significant benefits, it’s crucial to understand the associated risks and make informed investment decisions based on your individual goals and risk tolerance. By understanding the S&P 500 and its role in the financial landscape, investors can make more informed decisions and navigate the complexities of the stock market with greater confidence.

:max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg)

Closure

Thus, we hope this article has provided valuable insights into The S&P 500: A Foundation for Investment and Economic Insight. We appreciate your attention to our article. See you in our next article!