Unveiling the Secrets of Profit: A Comprehensive Guide to Price Markup Ratio

Related Articles: Unveiling the Secrets of Profit: A Comprehensive Guide to Price Markup Ratio

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling the Secrets of Profit: A Comprehensive Guide to Price Markup Ratio. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Secrets of Profit: A Comprehensive Guide to Price Markup Ratio

In the competitive world of business, understanding the intricacies of pricing is paramount. One crucial element in this equation is the price markup ratio, a powerful tool that allows businesses to determine their profitability and make informed decisions regarding their pricing strategies. This article delves into the multifaceted nature of the price markup ratio, exploring its significance, practical applications, and the benefits it offers to businesses of all sizes.

Defining the Price Markup Ratio: A Foundation for Profitability

The price markup ratio, also known as the markup percentage, represents the difference between a product’s cost and its selling price. This ratio is expressed as a percentage, indicating the profit margin a business aims to achieve on each unit sold.

Formula for Calculating the Price Markup Ratio

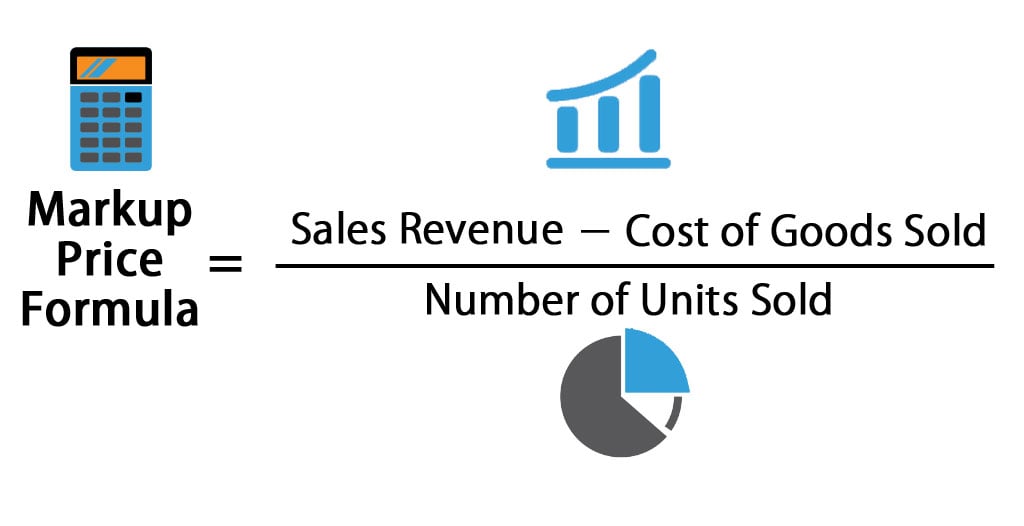

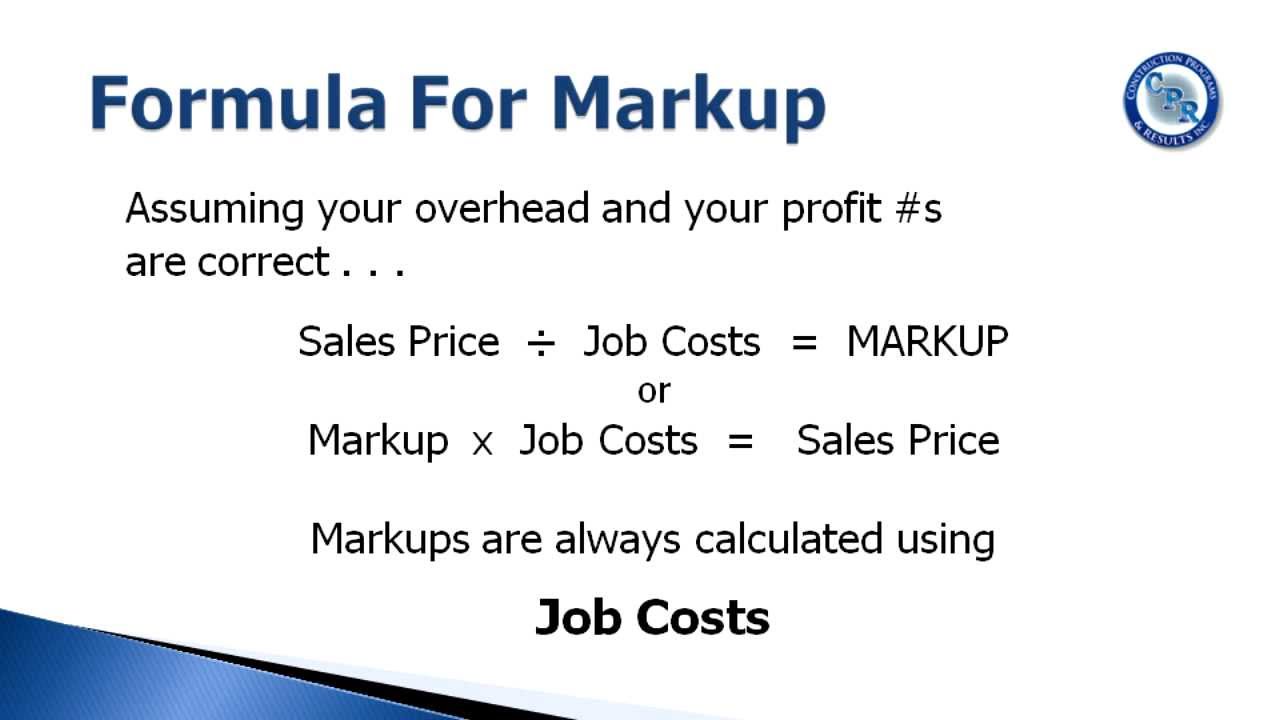

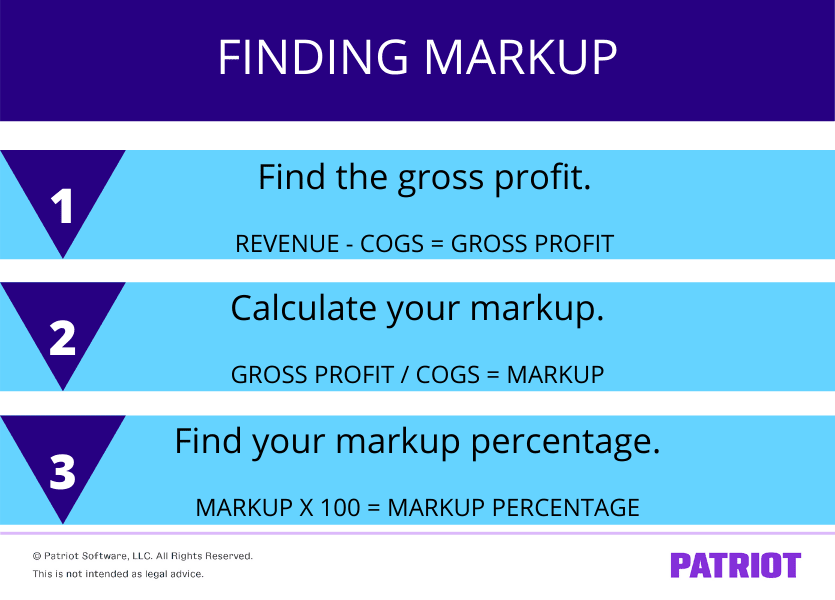

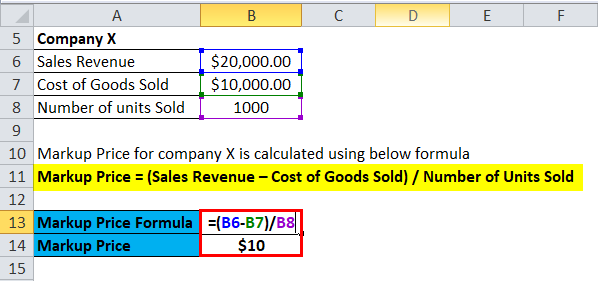

The price markup ratio is calculated using the following formula:

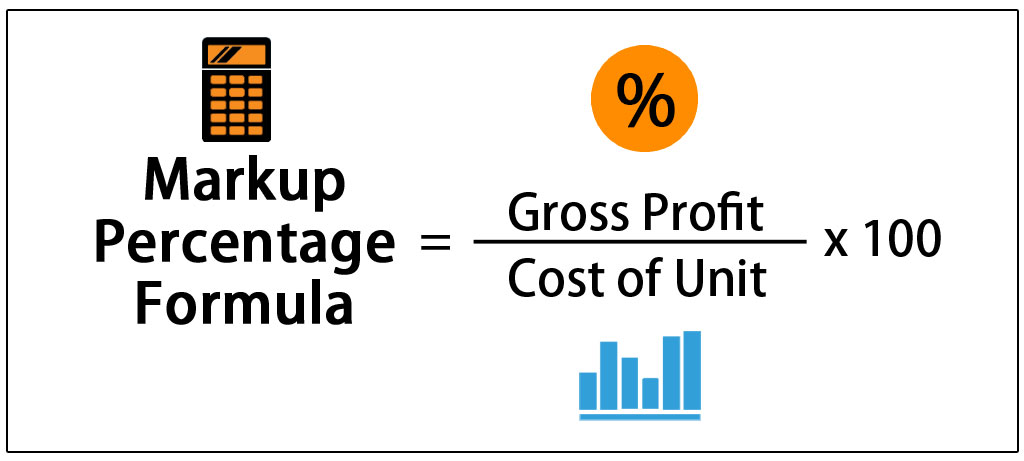

Price Markup Ratio = (Selling Price – Cost Price) / Cost Price x 100

Understanding the Components:

- Selling Price: The price at which a product is sold to the customer.

- Cost Price: The total cost incurred in producing or acquiring the product, including raw materials, labor, overhead expenses, and any other associated costs.

Illustrative Example:

Let’s consider a hypothetical scenario where a business sells a product for $100. The cost of producing this product is $70.

Applying the formula:

Price Markup Ratio = ($100 – $70) / $70 x 100 = 42.86%

This indicates that the business has a markup ratio of 42.86%, implying that for every $100 in revenue, $42.86 is profit.

The Significance of Price Markup Ratio: A Compass for Profitability

The price markup ratio serves as a vital indicator of a business’s profitability. It provides a clear understanding of the margin generated on each sale, enabling businesses to:

- Set Competitive Prices: By analyzing the price markup ratios of competitors and considering market demand, businesses can determine an optimal selling price that ensures profitability while remaining competitive.

- Optimize Cost Management: A high markup ratio can indicate efficient cost management, while a low markup ratio may highlight areas where cost reduction strategies are necessary.

- Monitor Profitability: Regularly calculating the price markup ratio allows businesses to track their profitability over time, identify trends, and make necessary adjustments to their pricing strategies.

- Evaluate Investment Opportunities: The price markup ratio can inform investment decisions by providing insights into the potential profitability of new products or ventures.

Factors Influencing Price Markup Ratio: Navigating the Dynamics

The price markup ratio is influenced by various factors, including:

- Product Type: Products with high demand or unique features often command higher markup ratios.

- Competition: In highly competitive markets, businesses may have to settle for lower markup ratios to remain competitive.

- Cost of Production: Higher production costs necessitate a larger markup to maintain profitability.

- Operating Expenses: Businesses with high operating expenses, such as rent or utilities, may need to increase their markup ratios to cover these costs.

- Target Market: The price sensitivity of the target market can influence the markup ratio.

Strategic Applications of Price Markup Ratio: A Toolkit for Success

The price markup ratio can be effectively employed in various strategic contexts:

- Product Pricing: Businesses can use the price markup ratio to set optimal selling prices for individual products or product lines.

- Cost-Plus Pricing: This pricing strategy involves adding a desired markup to the cost price to determine the selling price.

- Value Pricing: Businesses can leverage the price markup ratio to justify premium pricing based on the perceived value of their products or services.

- Promotional Pricing: The price markup ratio can be used to determine the optimal discount levels during promotional campaigns while still maintaining profitability.

Common Misconceptions: Debunking the Myths

Several misconceptions surround the price markup ratio, which can lead to misinformed decision-making. It is essential to address these misconceptions:

- Higher Markup Ratio Equals Higher Profit: While a higher markup ratio indicates a larger profit margin per unit, it doesn’t necessarily translate to higher overall profits. Factors like sales volume and market demand play a crucial role.

- Price Markup Ratio is a Fixed Percentage: The price markup ratio is not a static figure and can vary depending on the factors mentioned earlier.

- High Markup Ratio is Always Desirable: A very high markup ratio can deter customers and hinder sales, ultimately impacting profitability.

FAQs: Addressing Common Queries

1. What is a reasonable price markup ratio?

There is no universal "reasonable" markup ratio. It depends heavily on industry norms, competition, and individual business circumstances.

2. How can I determine the optimal price markup ratio for my business?

Conduct thorough market research, analyze competitor pricing, consider your cost structure, and assess the price sensitivity of your target market.

3. Can a low price markup ratio be profitable?

Yes, a low markup ratio can be profitable if sales volume is high enough to offset the lower margin per unit.

4. How does the price markup ratio differ from the profit margin?

The price markup ratio is calculated as a percentage of the cost price, while the profit margin is calculated as a percentage of the selling price.

5. Should I focus on maximizing the price markup ratio or sales volume?

The ideal strategy involves finding a balance between maximizing the price markup ratio and achieving sufficient sales volume to generate optimal profitability.

Tips for Effective Price Markup Ratio Management:

- Regularly Review and Adjust: Monitor your price markup ratio periodically and make necessary adjustments based on market conditions and business performance.

- Embrace Dynamic Pricing: Consider implementing dynamic pricing strategies that adjust prices based on factors like demand, competition, and time of year.

- Focus on Value Creation: Instead of solely focusing on maximizing the price markup ratio, prioritize creating value for customers through high-quality products, excellent service, and innovative solutions.

- Leverage Technology: Utilize pricing software and analytics tools to streamline price markup calculations and gain insights into market trends.

- Seek Professional Advice: Consult with financial experts or business consultants to obtain expert guidance on pricing strategies and price markup ratio optimization.

Conclusion: A Powerful Tool for Business Success

The price markup ratio is an indispensable tool for businesses seeking to achieve profitability and sustainable growth. By understanding its significance, calculating it accurately, and applying it strategically, businesses can make informed decisions regarding pricing, cost management, and overall business operations.

Remember, the price markup ratio is not a magic formula for success. It’s a valuable metric that, when used effectively in conjunction with other business strategies, can contribute significantly to achieving long-term profitability and market dominance.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Secrets of Profit: A Comprehensive Guide to Price Markup Ratio. We hope you find this article informative and beneficial. See you in our next article!